Published: 4 April 2024

The following regards the setup, oversight and operations of 2150 Urban Tech Sustainability Fund II SCSp (company no. B271472) (the “Fund”) managed by Urban Partners Management Company S.A. company no. (B186049) as the AIFM.

BASIC DISCLOSURES

Integration of sustainability risks in the investment decision-making process (art. 3(1))

2150 closely considers the sustainability risks of its investments using a common approach outlined in the 2150 Impact Framework. As a fund manager with a sustainable investment objective, all investments must demonstrate their contribution to the Fund’s mission (detailed below). Within this approach, 2150 then conducts thorough sustainability related due diligence assessing companies’ positive and negative environmental, social and governance outcomes. Such factors directly affect our investment decisions as well as targeted interaction with potential portfolio companies.

2150 has looked at the sustainability risks likely to have an impact on the returns of the Fund, and 2150 believes there is a low to minimal risk to the returns due to those sustainability risks.

No consideration of adverse impacts of investment decisions on sustainability factors

2150 does not consider the adverse impacts set out in Table 1 of Annex 1 of the Commission’s draft delegated regulation supplementing Regulation (EU) 2019/2088 (the Sustainable Finance Disclosure Regulation) (“SFDR”) of its investment decisions on sustainability factors.

The Fund relies on the general framework set out through the principal adverse impact indicators to shape its investment due diligence and annual evaluation of sustainable performance of the portfolio and its companies. 2150 uses the range of adverse impacts outlined in the indicators to form its evaluation of investments pre-investment. For portfolio management, 2150 more directly uses the indicators to assess companies’ annual performance. The aggregate results of these efforts will be documented in the annual 2150 Impact Report, which will be made publicly available. These reports are separate from reporting requirements specified for SFDR.

2150 as a Fund Manager does not consider adverse impacts of its investment decisions on sustainability factors as outlined in SFDR as 2150 does not find such indicators relevant in the context of the maturity and size of companies considered for investment.

2150 will review the option to consider adverse impacts of its investments decisions should the Fund identify a pathway to do so in the future.

Remuneration policies (art. 5)

2150’s remuneration policies are structured to the effect that these do not encourage excessive risk-taking with respect to sustainability risks. Further, 2150’s remuneration structures are linked to risk-adjusted performance.

Sustainability-related disclosures

Summary

The Fund seeks to accelerate the sustainable transformation of cities by investing in companies addressing pressing urban challenges. Our ability to address climate change will be largely determined in cities, as recognised by UN Secretary General Antonio Guterres. To achieve the goals of the Paris Agreement, we need to transform our urban areas in all regards, from the materials we use to build, to energy systems, transport, industry and beyond. The Funds’ objective reflects this layered approach to urban sustainability by targeting objectives of mitigation, adaptation and other environmental outcomes.

The Fund is an Article 9 funds, cf. SFDR, that invests in companies and solutions that will enable cities to reach net-zero by mid-century, while increasing their resilience and fostering wider sustainability. 2150 has put in place robust mechanisms to ensure that all investments meet high standards for both contributions to sustainability objectives while ensuring they do no significant harm. This approach is largely outlined in the 2150 Impact Framework, available publicly. The Framework outlines the Fund’s investment strategy starting from ‘problem identification’ through research, through to deal execution and exits including common term sheet expectations.

2150 seeks to maximise the proportion of the capital under management that is invested in activities with an environmental objectives that are aligned with the Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment (“Taxonomy Regulation”). However, 2150 is not currently in the position to describe this proportion. All (100%) investments by the Fund will be sustainable, and demonstrate a significant contribution to one of the environmental objectives.

To demonstrate positive contributions to urban sustainability, 2150 closely monitors the impacts of all investments and compiles this information in our annual 2150 Impact Report. Given the focus on climate, GHG mitigation is a primary metric used to demonstrate the Fund’s success. Where GHG emissions do not appropriately describe a company’s positive impacts, 2150 supports the company to develop metrics specific to their outcomes.

A reference benchmark for attaining the sustainable investment objective has not been designated for the Fund. While an index is not used, the investment strategy specifically targets companies that support the goals of the Paris Agreement. A pathway to net-zero is foundational to these considerations. This speaks to year-on-year emissions reductions that available indexes use to measure performance.

To coordinate efforts across portfolio companies and the Fund, 2150 regular convenes its Sustainability Committee to monitor and assess operations and progress on sustainability matters.

No significant harm to the sustainable investment objectives

As part of standard investment due diligence, as outlined in the 2150 Impact Framework, all potential investments are screened to ensure they do not cause significant harm to any EU environmental objective and meet the definition of ‘do not significant harm’ under SFDR. Where possible, this screening refers to the relevant activity in the EU taxonomy. Alternatively, 2150 assesses the companies’ alignment with the definition for ‘significant harm to environmental objectives’ described in Article 17 of the Taxonomy Regulation.

Further, investment due diligence includes evaluations of companies’ operations within the context of the adverse impact areas outlined through the PAI indicators. Screening also considers companies’ alignment with Minimum Safeguards, including a review of processes on human rights standards in the context of the OECD Guidelines for Multinational Enterprises, the UN Guiding Principles on Human Rights, and the Declaration of the International Labour Organisation on Fundamental Principles and Rights at Work and the International Bill of Human Rights.

Sustainable investment objective of the Funds

The Fund will seek to significantly contribute to the environmental objectives listed under Article 9 in the Taxonomy Regulation. Given the Fund’s focus on supporting the goals of the Paris Agreement, investments supporting climate change mitigation outcomes will be well-represented within the Fund. However, 2150 recognises that achieving the goals of the Paris Agreement cannot happen with a singular focus on greenhouse gas (“GHG”) emissions. To reflect this, the Fund will seek to invest in companies and solutions that contribute to other environmental objectives such as climate adaptation and biodiversity. As such, the investment objectives of the Fund can be understood as targeting mitigation, adaptation, as well as the wider Environment Objectives listed under Article 9 of the Taxonomy Regulation.

In the context of climate mitigation, 2150 seeks to invest in companies and solutions that will enable cities to reach net-zero by mid-century. Our approach to investment, examines sources and drivers of GHG emissions in urban contexts, and identifies companies that can address these sector by sector to achieve wider decarbonisation. Such solutions include, but are not limited to:

- development and installation of renewable energy;

- energy efficiency;

- clean and climate-neutral mobility;

- decarbonising industry and low-carbon materials;

- carbon capture, removal, sequestration, storage and utilization solutions;

- bioeconomy solutions and agricultural improvements; and

- clean and efficient fuels.

These solutions will reduce direct GHG emissions, energy consumption and embodied GHG emissions from the sectors and challenges they target.

To ensure that the Fund contributes to the efforts to reduce GHG emissions in view of achieving the objectives of the Paris Agreement, all investments instead undergo rigorous due diligence to assess their potential to accelerate the transition to climate neutrality while supporting the objectives of the Paris Agreement. This due diligence process is defined in the 2150 Impact Framework, which is publicly available. 2150 is thus focused on identifying positive contributors to decarbonisation and other sustainability objectives as a primary concern, where reductions in the portfolio’s footprint will follow.

At a minimum, all investments under the Fund must:

- Be aligned with the Paris Agreement, which includes evaluation of companies’:

- support for a low-carbon pathway in the relevant sector to 2050,

- potential to lock-in carbon emissions, and

- potential to undermine climate resilience in the context in which it operates; and

- Contribute to one of the Environment Objectives listed under Article 9 of the Taxonomy Regulation; and

- Not meet any of the exclusion criteria defined in Article 12 of (EU) 2020/1818 on the EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks, and not derive any revenues from the exploration, extraction, distribution or refining of fossil fuels or the generation of electricity with a GHG intensity of more than 100 g CO2 e/kWh.

The Fund’s objectives extend beyond solely climate mitigation. 2150 defines the Fund’s success by its ability to demonstrate substantial impacts in terms of GHG reductions, along with contributions to increased resilience to climate change; the sustainable use and protection of water and marine resources; the transition to a circular economy; pollution prevention and control; and the protection and restoration of biodiversity and ecosystems should investment opportunities arise. Such a diverse portfolio in terms of impact reflects 2150’s objectives for supporting systemic sustainable urban transformations.

Investment strategy

2150 applies a common investment strategy for evaluating the impact potential of companies and their contributions to sustainable investment objectives. This process is outlined in the 2150 Impact Framework as our “Investment Impact Approach”. The strategy builds a systematic approach to investment through a series of steps:

- Problem Identification: Build on 2150’s research and intelligence to pinpoint entry points to materially impact sectors’ sustainability challenges. Research is foundational to 2150’s investment strategy, where we develop ’Deep Dive’ research through which 2150 seeks to understand the specific challenges a sector faces in its sustainable transition to support our objective to be the most knowledgeable investor. Through the ‘Deep Dives’ we identify which solutions and ultimately companies to pursue for investment, understanding how they solve a specific problem and unlock opportunities within a sector.

- Screening: We review companies based on “knock-out” criteria linked to the Paris Agreement & EU Taxonomy. These are the minimum criteria as defined above in the description of the Fund’s sustainable investment objective. 2150 then takes a decision to proceed based on sustainability, financial and other investment considerations.

- Initial Review: We articulate the companies’ sustainable propositions, with estimates of scale of impact and TAM. This includes initial evaluations of the extent to which a company can contribute to climate change mitigation, or another sustainable investment objective, along with the potential scale of the sector and challenge it could address.

- Deeper Review: We develop quantitative bottom-up impact analyses of companies’ solutions, and top-down projections of impact potential at scale. 2150 completes full sustainability due diligence at this stage including initial screenings on climate related risks, governance structures within companies, and other ESG concerns. The process records areas for improvement should 2150 invest. Such evaluations consider good governance practices to ensure sound management structures, employee relations, fair remuneration and tax compliance.

- Term Sheet: We embed sustainability commitments including monitoring, net-zero targets and strategic planning in term sheets. All portfolio companies make commitments concerning adoption of climate policies and targets, impact measurement and reporting, and ESG and risk best practices.

- Investment Execution: We assess co-investors’ alignment with the companies’ and 2150’s goals, and ensure legal agreements include sustainability actions to codify sustainability objectives into the core of any investment.

Once a company becomes a part of the portfolio, 2150 makes ongoing efforts to advance and record their contributions to sustainable investment objectives. This is done through continuous monitoring and reporting, partially based on the principal adverse impact indicators presented above as the sustainability indicators used to measure the attainment of the sustainable investment objective of the Fund.

Proportion of investments

2150 seeks to maximise the proportion of the capital under management that is invested in activities with environmental objectives that are aligned with the EU Taxonomy. However, 2150 is not currently in the position to describe this proportion. All (100%) investments by the Fund will be sustainable, and demonstrate a significant contribution to one of the environmental objectives.

The sustainable investments will be in economic activities that qualify as environmentally sustainable under the Taxonomy Regulation and in economic activities that are not covered by the Taxonomy Regulation but qualify as sustainable investments under the SFDR.

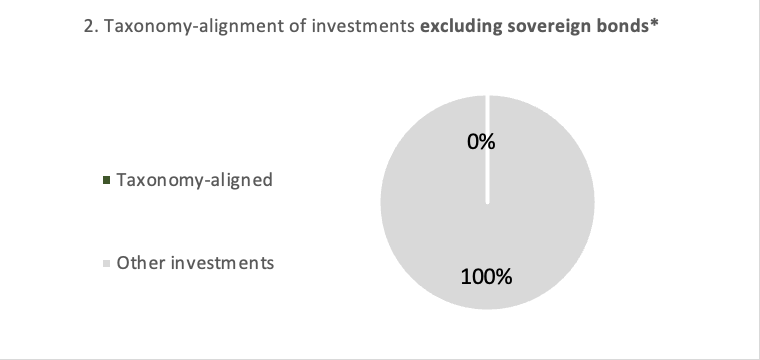

At the date hereof, there is insufficient reliable, timely and verifiable data available for 2150 to be able to consistently assess investments using the Taxonomy technical screening criteria. As such, 2150 is not committing to any Taxonomy alignment levels above 0% at this time because it is not possible to provide a range or accurate percentage at this stage.

2150 is keeping this situation under active review and where, in its discretion, it has assessed that it has sufficient reliable, timely and verifiable data on the Fund’s investments, 2150 will designate an investment as environmentally sustainable under the EU Taxonomy.

Asset allocation of investments

Minimum share of sustainable investments

The graph below shows in green the minimum percentage of investments that are aligned with the EU Taxonomy. The fund does not invest in sovereign bonds.

Monitoring of sustainable investment objective

2150 takes monitoring, reporting and management of sustainability performance seriously. As such, we engage our portfolio closely to report the following as aggregate results to measure the attainment of the sustainable objectives of the Fund:

- Total GHG mitigated in the past year (total and ownership adjusted), or

- Where GHG emissions do not appropriately describe a company’s positive impacts, 2150 supports the company to develop metrics specific to their outcomes.

Beyond these indicators, 2150 publishes an annual 2150 Impact Report that reports the portfolio’s GHG footprint, contributions to employment, diversity and governance.

2150 works with portfolio companies annually to monitor and report information relevant to the Fund’s attainment of its sustainable investment objectives. 2150 obtains the majority of its data related to monitoring through direct engagement with portfolio companies. Where possible, 2150 supports portfolio companies to report such information in line with international best practice such as the GHG Protocol.

Methodologies

As 2150 use positive outcomes to define attainment of its objectives, for example mitigation of GHGs, the methodology to determine such outcomes requires close engagement with portfolio companies to develop appropriate models. The Fund uses GHG emissions reduction or removals as a central impact metric, but will go further to ensure impacts from investments targeting objectives beyond mitigation are appropriately described. Underlying all evaluations is a common approach to assessing impact, building off efforts of experts in the field.

In particular, the 2150 closely considers lifecycle assessment data available for portfolio companies as a means of comparison to counterfactuals or ‘baseline’ conditions. Definition of a baseline is foundational to the Fund’s approach to impact, reflecting the approach developed by institutions like the European Bank for Reconstruction and Development and Project Frame organised through Prime Coalition.

Data sources and processing

2150 collects regular information from all portfolio companies on their positive impacts, GHG footprints and other relevant ESG metrics both quantitative and qualitative. With respect the GHG inventories, 2150 adheres to the principles of the GHG Protocol to report outcomes. Where possible, primary activity data is translated into relevant metrics, with estimates developed through interpolation of available data as needed.

2150 obtains the majority of its data related to monitoring through direct engagement with portfolio companies. This reflects the early stage nature of the companies in which the Fund investment. 2150 will prioritise publicly reported data when available. Where possible, 2150 supports portfolio companies to report such information in line with international best practice such as the GHG Protocol. 2150 uses Normative, a corporate sustainability reporting platform, to facilitate our impact data processing though reserves the option to rely on similar tools. Such platforms support a streamlined approach to common data reporting and management.

2150 seeks to limit data estimation; however, in limited instances relies on Normative and similar tools to translate portfolio companies’ activity and spend based data into relevant adverse impact metrics.

Limitations to methodologies and data

Data and methodological limitations relevant to 2150’s operations and impact oversight are not unique to the Fund, but represent common challenges for measuring, interpreting and reporting ESG relevant information. These limitation do not affect the attainment of the sustainable investment objective of the Fund, given the data sources and processing efforts outlined by 2150 in the section above.

Due diligence

2150 employs the investment strategy above to all companies and potential investments. All investments meet the minimum criteria described under the ‘Screening’ step, and all companies are evaluated based on multiple further dimensions of impact contributions, governance and ESG best practice. Further details on this due diligence process can be found in the 2150 Impact Framework.

All investments undergo rigorous impact, sustainability and ESG related due diligence to ensure the Fund can support the companies, they positively contribute to the Fund’s objectives, and have in place appropriate processes and safeguards. An initial screening first ensures a company meets 2150’s minimum criteria for investment. Following a positive review, 2150 conducts further due diligence to assess alignment with the SFDR. Even though 2150 is not committing to any Taxonomy aligned investments, a taxonomy screening will still be conducted. Further due diligence then considers companies’ sustainability and ESG related practices, to ensure alignment with Minimum Safeguards while highlighting areas for targeted engagement should the fund invest.

Engagement policies

Good governance is critical to companies’ ability to continuously increase their contributions to sustainable investment objectives, while monitoring and reporting on outcomes. We assess the extent to which sustainability considerations are embedded in a company’s core targets and information regularly reporting the management and the board. 2150 gives particular focus to company’s tracking and reporting of sustainability related outcomes and impacts, and climate and sustainability related risks and opportunities. Further, we consider ESG factors such as diversity, equality and inclusion, and risks that may arise from companies’ operations. Within 2150, a Sustainability Committee meets regularly to commonly monitor and assess engagement with invest companies on such matters.

Attainment of the sustainable investment objective(s)

A reference benchmark for attaining the sustainable investment objective has not been designated for the Fund. Given the early stage and dynamic nature of venture capital, benchmarks as designed under Article 9(3) of SFDR are difficult to define and operationalise as a means of measuring progress year on year. Metrics such as carbon intensity based on funds invested or enterprise value will change drastically year on year based on factors beyond companies’ concerted decarbonisation efforts. An index, particularly describing GHG intensity of portfolio companies in relation to ownership, is not available for venture capital portfolios for the stage of investment on which the Fund focuses to an extent where comparison is feasible.

While an index is not used, the investment strategy specifically targets companies that support the goals of the Paris Agreement, both through accelerating a path to net-zero and supporting resilience in the context in which they operate. Companies are asked to demonstrate continued and measurable growth in their contributions to mitigating emissions through regular monitoring and reporting. 2150 uses this approach to assess year-on-year improvements towards net-zero, examining the reductions in emissions intensity for investments when available.